Many of you have probably seen TV/Internet advertisements promoting “incredibly cheap” lease payments on premium vehicles such as BMW, Mercedes, Audi and Infiniti (to name a few). I am also willing to bet that many of you – who otherwise wouldn’t be in the market for a new car – were probably enticed by those ads as well. If those low payments have peaked your interest then some marketing guru just earned their paycheck.

These ads have one simple goal – to get you interested. Does it mean it’s that cheap? In most cases, it’s not. In the world of auto leasing, potential lessee must understand two things… 1) The less you put down, the better. After all, you have to return your car at lease end, so why give away so much of your hard-earned money? 2) Options, fees and individual tax situations can change the deal from a seemingly “good deal” to a “bad”one.

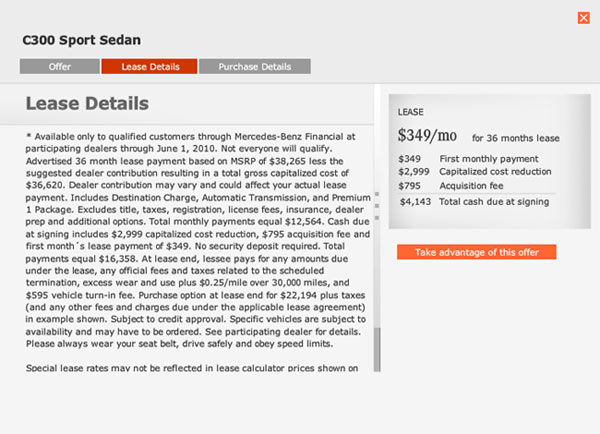

Lets examine Mercedes Benz’s “Special Lease” offer on the C300 Sport…

The ad states a $349/mo lease payment, exclusive of sales tax. In Los Angeles county, we pay around 10% tax. So that $349/mo payment, its more like $390/mo. Next, we have the obligatory “first month” payment, which is due at signing. Then, the deal requires that you “contribute” roughly $3000, to bring down the payments to that “$349/mo” range. Now lets talk fees. More often than not, the bank will charge you an acquisition fee, in this case, it is $795. This fee covers the processing fee of applying for a lease loan and it typically covers the GAP insurance as well. I say typically because not all banks offer that (i.e. Toyota require that you pay extra). At most MBZ dealerships, the bank fee is usually bumped to $1095 (a $300 mark-up) for the bank acquisition. Is that legal? Yup, it sure is. Dealers are allowed to impose any fees they want and they can also mark up the money factor, therefore, it is your job to filter out the phony ones from the legitimate ones.

In the end, your out-of-pocket will end up being roughly $4200 due at signing. Also keep in mind that ad doesn’t include sales tax on the fees you are paying, DMV registration, county and state fees. In the end, you would be looking at $5000 out of pocket, $349/mo + tax. Not as good as it used to sound, does it?

The Right Way to Lease

The proper way to lease a vehicle is not too different from buying a car. You have to negotiate a sale price. Do not negotiate payments unless you know what how much you SHOULD be paying. Payment negotiation should be left to those who have pre-calculated their payments in advance. If you are relatively new to leasing, try breaking down the numbers one by one so you know what you are paying for. For more information check out my Guide To Auto Leasing.

All that $ for a car about the same size as a honda civic. Almost 500 per month.

yeah, it does seem quite expensive, but the C300 doesn’t drive like a civic. 🙂

Great insight G, and truly a great blog you have here. So helpful. Thanks!!!

Kudos G! well said.

@all

nice post G,

we need cars like that, how else could guys like me get a girl? A few hundred more a month and not home on a sat nite (priceless) lol

thanks all. I think that for the average person who normally doesn’t lease, these ads are really misleading. It gives a sense that luxury cars are affordable, but they really aren’t THAT affordable. Sure, sometimes there are pretty decent deals out there, but getting a 30-40k car for 300 bucks a month without paying a load upfront is VERY rare. Specially now when leasing isn’t as good as it was a few years back.

Mad props to you G for all the work you do in helping us consumers cut through all the BS in these leases. Another drawback to down-payments is that it’s taxed (i believe), so you’re not getting the full value of your out-of-pocket cash. In high rate areas like LA the difference could be several nice dinners at Ruth’s Chris! Oh, I was hoping you’d complete the ad example by backing out the residual & money-factor (if possible).

thanks damon. you are correct about the down payments being taxed. so like you said, in places like LA, you are actually applying only 90% of what you put down towards the cap cost reduction. Here’s a quick number crunch based on the MSRP on the ad.

C300 Sport + Premium 1 + Auto Transmission MSRP: $38265. Invoice: $36248. Sale Price: $35,000. Residual 55% (36mo/15k), MF: 0.00057.

Monthly Payment: $419 per month + tax. $2000 due at singing.

If you opt for the 36mo/10k, as is the offer on the ad, you’d be looking at $388 + tax per month with about $2000 due at signing.

I think that overall, you save yourself about $2000 if you negotiate a sale price of around $35,000 instead of opting for the advertised deal. That’s more than a few fancy dinner, right? 😀

I’m a young guy here G, you say leasing was better few year back…any examples of how they used to be? And are we talking 2 years back or more like 10 years ago?

@pchukwura. I am talking since a few years back. In the last year, we’ve seen residual values drop dramatically. Two year leases also become more expensive and less desirable over the last year as well. Of course, there were still some pretty insane deals going on last year due to heavy discounting and rebates, but for most cars, the banks have normalized their residuals, making leases a bit pricier. You can check out “The List” at the top of the website’s menu for old examples of what leases used to be. I have stopped doing calculations because they simply take way too much time, but it should give you an idea as to what payments used to be like on some cars.

It’s important to be able to cut through all the rhetoric and sumarize all the data and important information in a promo lease Ad. This will serve as a checklist of sorts…

Avaliable through June 1, 2010

2010 MB C300 Sport Sedan

MSRP …………………… 38,265

Sell Price………………. 36,620 NEGOTIABLE

Amounts Financed…………. 0

Gross Cap……………….. 36,620 Sell Price + Amounts Finance

Cap Reduction……………. 2,999

Net Adjusted) Cap………… 33,621 Gross Cap – Cap Reduction

Residual Value…………… 22,194 (Res Factor x MSRP)

Residual Factor………….. 58% (Residual Value/MSRP)

Calculated Money Factor…… 0.00057 (buy rate = 0 profit rate)

Term……………………. 36

Monthly Base Payment……… 349 (plus tax)

Front End Lease Charges

1st Payment……………… 349

Acq Fee…………………. 795

Cap Reduction……………. 2,999

TOTAL DUE AT LEASE SIGNING… 4,143 (Plus any applicable tax)

Back end Lease Charges*

Disposition Fee…………. 595

Excess Mileage Charge……. 0.25 per mile

Excess wear/Tear Charges…. ???

Applicable Taxes………… ???

TOTAL DUE………………. ???

*Assumes normal (regular) termination

Lease Contract

Annual Mileage Allowance…. 10,000

GAP Coverage……………. ???

Excess Wear/Tear Criteria

Restrictions

Commentary

It’s also important to recognize that the sell price, also known as Agreed Upon Value, is negotiable and that a down payment (i.e., cap reduction) is not absolutely mandatory depending upon credit. Every leased car is a sold car. So, purchase the vehicle first and negotiate sell price. Sell price should be the initial focus; not monthly payment. I don’t advise making a cap reduction. A car is a depreciating asset purchased for consumption and is, therefore, an expense and not an investment. No savvy investor would ever invest in a stock that they know will lose value over time. Also, if the vehicle is totalled or stolen, and never recovered, you may forfeit part or all of your cap reduction. However, if the lease rate is high compared with savings rates, you may want to consider a down payment and take the gamble. If you qualify, be sure that the money factor reflects the buy rate which is the lowest rate possible as it reflects zero profit. Also, most upfront fees can be capitalized (i.e., financed) in the lease including 1st payment, taxes, and yes, even security deposits if the fund provider approves. This is an attractive option particularly if the lease rate is low compared with savings rates.

Once you understand leasing, have created a lease calculation spreadsheet, and have done all of your homework; it’s time to create a one-page lease proposal, formatted as above, and Fax/email it to the dealer on your letterhead. It must be professional looking and contain no errors of any kind. Then, negotiate via phone/email from the comfort of your home/office with your spreadsheet lease program ready to rock’n roll! The only thing you’re likely to change is the sell price which only requires a few keystrokes. And, bing-bang-boom; you’re done!

Finally, it’s imporant to know what’s happening at the front-end of a lease (front-end charges) as well as at the back-end of a lease (potential back-end charges) so that there are no surprises.