During New Years last week, I attempted to get an appraisal on my Sonata to see if I would have the same luck I did with my Infiniti G37. Back in 2011, I was able to get about $1129.80 after trading-in the G37. This time around, I was hoping to break even. What I got was a much more disappointing result. Early in the month of December, I got an appraisal offer from my local Chevy dealer. Using an “automated system”, they offered me approximately $14500. The dealer then told me that they could “probably” bump it up to about $15000, but that is the best they could do. At that time, my payoff from Hyundai was about $19300. That figure was ridiculous because my Residual was supposed to be in the $16000 range. How do you go from $19300 down to $16000 with only 4 monthly payments at $362 per month??? My thinking was that Hyundai was adding sales taxes to that number and a possible “buyout” fee, which has become ever so popular these days (just look at your lease contract closely next time and you might see it. I saw mine on my Volt’s US Bank lease). If I took taxes into consideration (which I really shouldn’t have to pay on a trade-in) I get somewhere in the vicinity of $17000, which is closer to my residual, but still on the higher side. One has to wonder how Hyundai calculates their residual values. Personally, I blame the popularity of the car. Hyundai seems to have cranked out one too many of them and it’s starting to drive down resale values.

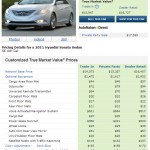

Moving on, I clearly didn’t want to pay nearly $5000 of negative equity so I went home, detailed my car, took it to CarMax and was offered $15500. The reason why CarMax offers a slightly better trade-in is mainly due to the fact that they go by Auction pricing instead of all the KBB nonsense. Attached in this post are some of the “estimates” I got via the Edmunds and KBB websites. I also included my CarMax offer for your reference. The dealer offered me $14500-$15000. CarMax $15500, Edmunds estimated my trade-in (in good condition) to be $15947 and KBB thought my car was worth $14321. As you can see KBB gives you a good idea as to what the dealer would give you. Edmunds seems to overvalue your trade-in.

Overall, I think using online tools to estimate trade-in values can be hit and miss. It is always a good idea to get an actual offer so you know exactly how much your car is worth. However, I think based of this experience, it’s likely safe to anticipate your “real” trade-in offer to be somewhere between what KBB & Edmunds estimates your car is worth. Ideally, you probably want to have access to Manheim Auction information to get an idea as to how much your car fetches in the wholesale market.

So after all this craziness, I have decided to finish off my Sonata lease which matures in April. It’s an okay car. I still find it irritating to pump gas, but whatever. I won’t be visiting the gas station too much in the next three years so I will get over it. 🙂

PS: I GOT MY COSTCO CASH CARD YESTERDAY!!!

- KBB Online Appraisal

- Got my Costco Cash!

- Edmunds Online Appraisal

- Appraisal Offer from Carmax

Crazy!

Question G, when I got into my current lease I was a negative about $3800.00 from my previous car and was rolled into the car loan. Im going to try to see if i could terminated my lease this year 2014 when it hits the 2 year make. That is if I break even (being hopeful) if not I will have to stay with the car till lease end. Now leading up to my question, Since that negative equity was rolled into my lease at lease end to trade in will i have to be paying for it upfront? or once I commit to all payments that we agreed to I will be at a $0 balance. A little confused on this and only got into the lease because they told me i would be best to get into a lease to get rid of the negative equity and once the lease ends i will be in a $0.00 balance and start fresh. Mind you this was my first lease and didnt know as much as i do now thanks to your site and the research I have been doing. Any feed back would be greatly appreciated and thanks again for having a site like this up and running because i think it is sad that everyone works hard for their money and the dealer takes advantage of people like this never again will i do something blindly and not do my research. Now the dealer better be prepared for me when I will be needing a car.

Julio,

Once you have finished paying the current lease (which you rolled $3800 into) you will no longer owe any money on either vehicle. Think of it as “consolidating your payments” into one. Now, if you plan to unload the current lease and get into another, then you will need to check your payoff and see if the trade-in offer comes near it. If you still owe money, then you would probably have to roll that into the new lease (which I don’t advise). Personally, I don’t like to lose money. I’d rather have two payments and be able to drive both cars than to be paying for another car I can’t drive.

Going back to what people had said about getting a fresh start. Yes, it is technically true, but that’s because you are paying for the new car AND the old car’s negative equity at the same time. Which blows in my opinion.

Your best bet right now is check the trade-in vs payoff on your current car and see where you are at. If the gap is too great, just ride out the current lease so you can get something else later without having to drag more negative equity from another bad lease.

will do seeing my options, Thanks again G for the response

No problem. Let me know if you have more questions.

I think its simply that Hyundai has inflated the residual values to drive leases. Even if they legitimately thought that is what the car would be worth at the end of 3 years, they missed the mark. Honda’s are extremely popular, readily available, and consistently the residual value is at or below what the car is worth at the end of a lease.

That’s true. I think Hyundai was trying to move cars so that is why they inflated the numbers a bit. They didn’t start being decent leases until the last 3 years.

This is very disappointing to hear as I was looking to get out of my 2.0T a bit early. Guess I’ll ride it out. Not a bad car but not the Lexus I moved out of. Lexus seems to have some nice leases on the CTh and the GS. It appears I can get my wife out of her RX and into a CTh for less than the Sonata 2.0T limited. And 48mpg. Was going to try a two car deal w/ the Sonata and the GS. Which should come out right about the same as the RX. Two Lexus’, or is that Lexi?, for less than a Hyundai and a Lexus.

And yes, there are a TON of Sonatas out there. You can blame me. I picked up mine in July 2011 and would turn heads in some very nice cars. I was amazed at how many people needed to see that Sonata when I drove by. Same way I was when I first saw one. But there’s too many and it’s lost it’s luster. I’m hoping there’s a bigger demand for the 2.0T and I’m sure Limited w/ Nav won’t hurt. I even considered the Kia to get away from the mass’ of the Sonata but it seems that it’s nearly as popular. That diamond interior is very nice though.

I completely agree. The Sonata was nice when it first came out. But they made it so easy to get one (a base model could be had for under $20k very easily) so it really diluted the pool. I sometimes miss my 325i, I miss my A4 Quattro on rainy days, I miss my G37 on sunny days. I don’t see myself missing the Sonata for any particular reason. LOL.

Right now, my Volt + Pilot will be cheaper to lease and operate than my Sonata + Pilot combo, or the Sonata + Jetta combo I had the year before.

For Lexus, it looks like the GS can be had for under $500 (See Julio’s post in the Lexus Group) and the CTh, last month was $375 or less with $700 (there was still room to go down though). My issue with the CTh is that it’s tiny and there isn’t much pickup. MPG wise, it’s great for road trips compared to the Volt. Originally, I really wanted to get a car I could buyout, which is why I was looking at the CTh, but those dang gov’t rebates were just too appealing. LOL

I am kind of in a similar boat to you. I was looking at Lexus too. Could you please be more specific? I was looking at the GS350 as well (F-Sport package, fully loaded).

TrueCar kicks back about a $54k (off of the $59k MSRP). That looks to be around $600+ for leases any way you spin it. What exactly are you talking about it being less than a Hyundai?

I think he was referring to the CTh, not the GS being cheaper than the Sonata. Because it isn’t.

I forgot the 😉 after ‘you can blame me’.

Listen to this Guys!

I went and got my car appraised this past weekend from CarMax on my 2013 Volkswagen Passat SE everything was perfect got the price i was looking for until Carmax had to contact the bank to get the payoff from the dealer to make sure it was the same on my lease contract. Thats when it goes down hill from there, the bank tells me and the carmax associate Audi and Volkswagen give you “the LEASEE” a negotiated at the end of your lease if you decide to purchase the vehicle that is the price you will be paying. Now if a dealer (That isn’t them, This case Carmax) wants to purchase the car and is worth more then what they negotiated Audi/Volkswagen can sell them the car a retail price because we are taking the opportunity to sell that car at their dealer for retail price and there for loosing profit. So in order for them to prevent they do this so you are forced to take the car back to the same dealer. Which to me is BULL^$#@!!! So I’m basically suck with the car till the end. my payoff was $15000 ( this is an example not real numbers) carmax matched it volkswagen told carmax the pay off was $17000, Then saying i was upside down $2000. Crazy how these major car companies work. Now My last questions Lets say I stay with this lease Im originally suppose to have 36000 miles at lease end if I turn that car in under miles will that same dealer that i purchased the car from cut me a check of the difference if my car is worth more then what was actually negotiated ? this has me worried because I know for a fact I will be under miles but I don’t want to risk in paying for so much miles and they are not even going to cut me check if the the car has lower miles then it was suppose too. Again If anyone has any feed back in trade in fro volkswagen your feed back will be great! until then guys anything you’ve learned post it only makes us more educated. Thanks again guys for your time

I totally understand your situation. If you still have a fairly long term left on your VW, try finding someone to assume your lease. You may also want to try to find an Audi/VW dealer that is willing to buy your car without having to purchase one from them. You probably won’t get CarMax price for it, but it’s better than being upside-down $2k or having to continue making payments and insurance on the car. Worse case, you can try to find a buyer yourself and have a dealer assist in the transaction. The downside is that this is a very rare situation. Maybe the guy that you got the GS from can help?

@G he gave me some advise he told audi and volkswagens are the worst car to lease because it is almost guaranteed to below value at trade in. Im going to try to post my car on sites to see if I get any takers, But I will most likely be stuck with the car till lease end. But Im not going to stress it it was a very expensive learning experience. Thanks G for your responses. Will keep you guys posted.

I have to agree about Audis not being great for leasing. Their RV is usually really low and the are very few exceptional promotions on them. Factor that in with the trade-in issue and they just aren’t as appealing anymore. VW on the other hand, lease well. They also have the maintenance program that’s great. What I don’t like is when you try to end the lease early. They typically try to screw you. However, one of my readers has managed to find a workaround. http://www.ridewithg.com/2009/08/selling-your-lease/

Not sure if you read that before, but really good info if you plan to do something like this again.

Thanks G, definitely going to read it

Funny, I’m looking at getting out of my ’12 Sonata Limited 2.0T lease early as well. Car is decent but I need something more refined. The steering pisses me off.

Is yours a SE 2.0T?

My buyout is $18.6 and I have 29k miles. I am hoping to be able to break even in a few months when I get serious about finding a replacement (’15 WRX or used ’13 SHO). Don’t want to wait another 12 months!

Yes, the steering is pretty annoying. I keep telling myself this is a lease and it will be out of my driveway soon. I completely agree with you on the refinement of this car. It’s so lacking. I feel like they had a good design but simply just pieced it together to get a working model for sale.

Mine is a 2.0T SE. My armrest storage compartment is squeaky and loose now. My speakers went out last week. Had to be reset in order to get them to work. I had no idea that my radio/nav had a designated reset button. 2 more months that’s all I have to say.

As far as breaking even I’m not sold on the Sonatas holding enough resale value to come close to break even. I think I had 29,000 miles on mine back January ( which was about 3000 less than where I should have been) and I was still $5k under. I do wish you luck though. Hopefully can get off the lease relatively unscathed. I have no plans to lease a Hyundai in the future. I think I am done with the brand as a whole.